|

DON'T THINK IT WON'T HAPPEN TO YOU 383 families are expected to lose a breadwinner every day in South Africa. Most claims on life insurance policies are for deaths caused by:

Source: Claims statistics from Old Mutual, Momentum and Sanlam (2019 and 2020) |

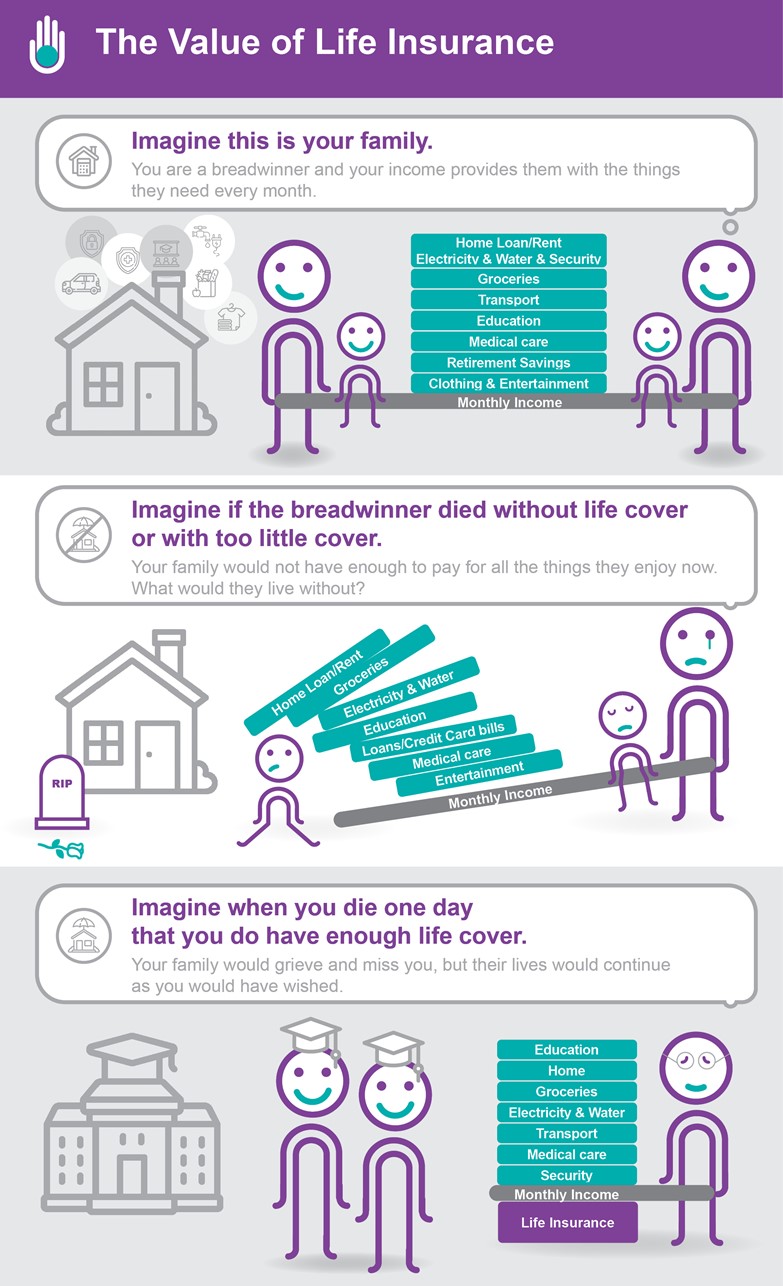

If anyone is dependent on you and your ability to earn an income, you should consider insuring your life.

If you have no dependants – if you are single with no children, for example - and no debts, you may not need life cover but you should still consider disability cover.

If you have a spouse, life partner, children or any other family member dependant on you for ongoing financial support, you should consider taking out life cover to ensure they have enough to sustain them should you die before retirement, or before you have saved enough to support them.

This is because the benefit paid out in the event of your early death can:

Provide your spouse or family with an income;

Pay off your debts;

Secure your home and other assets such as your car;

Ensure your savings goals such as tertiary education for your children are achieved; and

Pay your funeral costs.

If you own a business, you may also want to consider taking out life cover on a partner’s life so you can buy his or her share should he or she die while you are still operating the business.

Conversely, he or she can insure your life so he or she can buy your share should you die, ensuring that your heirs receive a fair price for the business.

What does it cost to insure your life against death, disability or severe illness?

What does it mean if my ocver is accelerated or standalone?

Why it is important to name beneficiaries on a life policy?

Who will inherit if I die without a will?

What is an estate?

What is keyman insurance?

Does my business need keyman insurance?

Does my business need a buy-and-sell agreement?

Do I need disability cover?