Living from pay day to pay day is stressful. The days after your money runs out are either ones of deprivation, or ones during which you have to borrow, or buy on credit.

Using credit or taking out a loan is likely to come with consequences, like a high interest rate, that will only make it harder to make it through the following months.

Using credit or taking out a loan is likely to come with consequences, like a high interest rate, that will only make it harder to make it through the following months.

A spending plan or budget is the way to regain control so that you know what you will spend your money on and how it will last the month.

You may think budgeting is boring or for people who don't have fun, but the trick is to cut your spending without depriving yourself of the things that you really enjoy.

Budgeting should be about identifying what you need and want in your life and prioritising how to getting it.

For example, you may need to exercise to feel healthier and more motivated, but you may be able to do that without the cost of belonging to a gym. An exercise buddy, a home workout or a run may be cheaper ways of getting fit.

Eating out may be costing you, but is it the food or the social connections that make you feel good? Could you connect more cost-effectively over a picnic?

School fees at a good school may be over-burdening your budget, but are your children getting what you expect from the school? Could a less expensive school with some private tuition or extra-murals fill the same need?

Budgeting should not be like a diet you never stick to. Slashing expenses might work for a while, but if it’s not a way of life you can stick to, you’ll probably soon give into impulse spending.

Instead your budget should map out how your resources can best satisfy your needs and yur wants. That is why everyone's budget will look different.

You can use a piece of paper, an Excel spreadsheet, an app or the Smart About Money Budget Planner.

STEP 1. LIST YOUR INCOME

Start with a list of your income - your salary, business earnings, pension, stipend or if you are a student, bursary or allowance.

![]() If your income varies from month to month, average it out over the past six to 12 months.

If your income varies from month to month, average it out over the past six to 12 months.

If you earn income from other sources, such as rental income, or you are drawing from an investment or making some money on a side-hustle, include it in your list.

Step 2. LIST YOUR FIXED EXPENSES

Then list your expenses keeping these categories in mind:

Your contractual expenses are costs that you are obliged to pay.

![]() Contractual expenses include expenses that if you did not pay them would affect the quality of your life or your credit rating:

Contractual expenses include expenses that if you did not pay them would affect the quality of your life or your credit rating:

These are things you pay to protect your financial life from unexpected life events and includes:

If you stop these premiums, you may not experience any immediate effects, but it puts you and your family at financial risk.

![]() An accident or health event that prevents you from being able to work for months, or even forever, denies you, and those who depend on you, the income on which you need to live and use for medical care. If you have outstanding debts, you would then be unable to repay these which could see you lose a home or car.

An accident or health event that prevents you from being able to work for months, or even forever, denies you, and those who depend on you, the income on which you need to live and use for medical care. If you have outstanding debts, you would then be unable to repay these which could see you lose a home or car.

You may begrudge the amount you spend on short-term insurance, but it safeguards your budget and your savings from a financial disaster if you lose your belongings.

STEP 3: PAY YOURSELF FIRST

Your spending plan should include provision for improving your financial life – you should pay yourself first. This means automating the decision to save an amount each month.

If you have a lot of debt, your payment to yourself may be an additional repayment into your debt to pay it down faster – when your debt is repaid you can use that money to save and invest.

![]() Setting up a regular transfer to a savings or investment account, commits you to it and living without that money will become a habit.

Setting up a regular transfer to a savings or investment account, commits you to it and living without that money will become a habit.

Knowing you are paying yourself can also help you view your budget positively rather than associating it with deprivation and a bad experience.

Making room in your budget to save and invest may mean you must delay some instant spending, but doing so will enable you to achieve more meaningful spending later in your life.

In this part of your budget include:

Your first savings goal should be an emergency fund that can cover the cost of emergencies that may arise in your life – a family health crisis, a burst water pipe, the excess on your insurance in the case of an accident in your vehicle, a sick pet and even the loss of a job. Read more: How do I set up an emergency fund?

Try the Smart About Money Growing my savings calculator to see how much you can save over time or if you want to achieve a savings goal, use the Smart About Money Savings Goal Calculator to see how much you need to save each month.

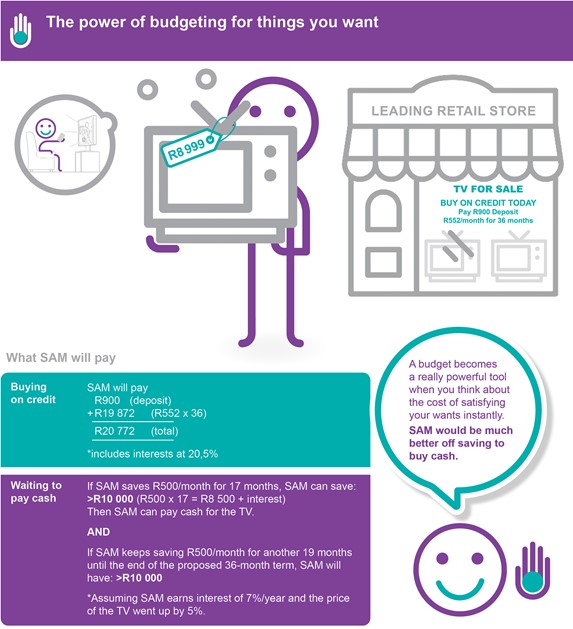

When you set a goal and save for something instead of buying it on credit, it means you spend less achieving that goal: not only do you avoid paying interest on a loan, but your savings earn interest that works for you.

STEP 4: LIST YOUR DISCRETIONARY EXPENSES

Discretionary (optional) expenses are those over which you have some control when it comes to ![]() how much you spend.

how much you spend.

Some of these expenses are necessary, but just how much you spend is something you can, with a bit of effort, control.

Analyse your spending and then plan how much you want to spend on:

Necessities

These are all necessities, but whether you buy the basics or gourmet foods and designer clothes, and the electricity you consume are all things you can, with some effort, control.

Wants

Your wants are the things you can get by without, but they may be important to you in your life. Carefully consider each one and its appropriateness given your financial situation.

Are you able to afford them, but at the cost of paying down debt or saving for retirement? What is more important to you? Could you live without the most expensive subscription package and make do with a cheaper streaming service if it meant you could direct more money to your savings for a goal?

STEP 5: TRACK YOUR SPENDING

Your first budget is a planning tool. Then you need to monitor your adherence to it. You can add ![]() an actual expense column for each month of the year, checking what you have spent against what you budgeted for.

an actual expense column for each month of the year, checking what you have spent against what you budgeted for.

Or you can use an expense tracking service. Most banking apps have these or you can find independent ones that analyse your spending from any bank and investment accounts you link. These trackers categorise your spending for you so you can easily see how your expenses line up with your plan.

STEP 6: ADJUST IT UNTIL IT WORKS

Initially you may fail to keep within your budget and you will need to consider what went wrong ![]() and to either plan for another expense or find something to trim to even out overspending elsewhere.

and to either plan for another expense or find something to trim to even out overspending elsewhere.

It may take you some time to perfect your budget, but if you don’t begin you will never be in control of your money.

Getting it in place builds the cornerstone of the rest of your financial plan. From there you can set goals and start building wealth.