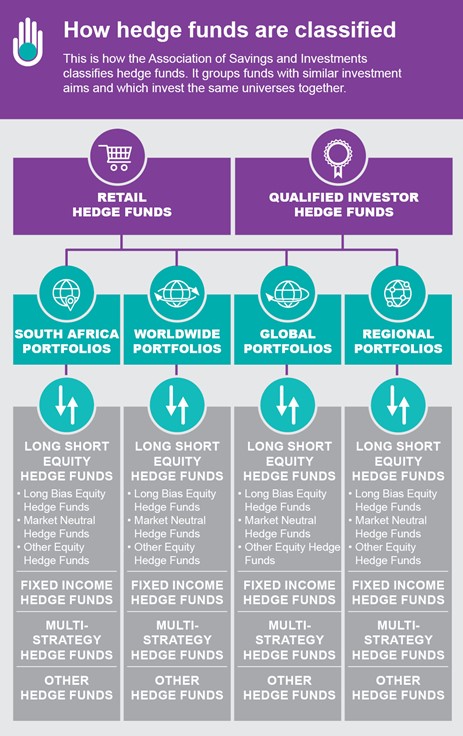

Hedge funds are classified by the Association of Savings and Investment South Africa depending on:

The Association for Savings and Investment South Africa (ASISA) introduced a classification standard for hedge funds in South Africa from January 2020.

This makes it easier for you to assess and compare funds and to select hedge funds appropriate for your risk profile and investment portfolios.

The classification standard has four tiers.

Tier one

In this tier funds are classified as either:

Tier two

The second tier classifies hedge fund portfolios according to their geographic exposure:

Tier three

The third tier of classification is based on the manager’s investment strategy:

Tier four

The fourth tier of classification applies only to Long Short Hedge Fund portfolios. These portfolios are further categorised as follows:

Market Neutral Hedge Funds: these funds are expected to deliver returns that are not linked to the swings in the market and are not correlated with any individual stock. Over time, their effective average exposure to shares (after the long and short positions offset one another) should be less than 25% of the fund but greater than minus 25%.

Market Neutral Hedge Funds: these funds are expected to deliver returns that are not linked to the swings in the market and are not correlated with any individual stock. Over time, their effective average exposure to shares (after the long and short positions offset one another) should be less than 25% of the fund but greater than minus 25%.When there are five or more hedge fund portfolios in either the qualified investor hedge fund or retail investor hedge fund, categories with similar objectives and investment policies, ASISA will consider adding a new category.