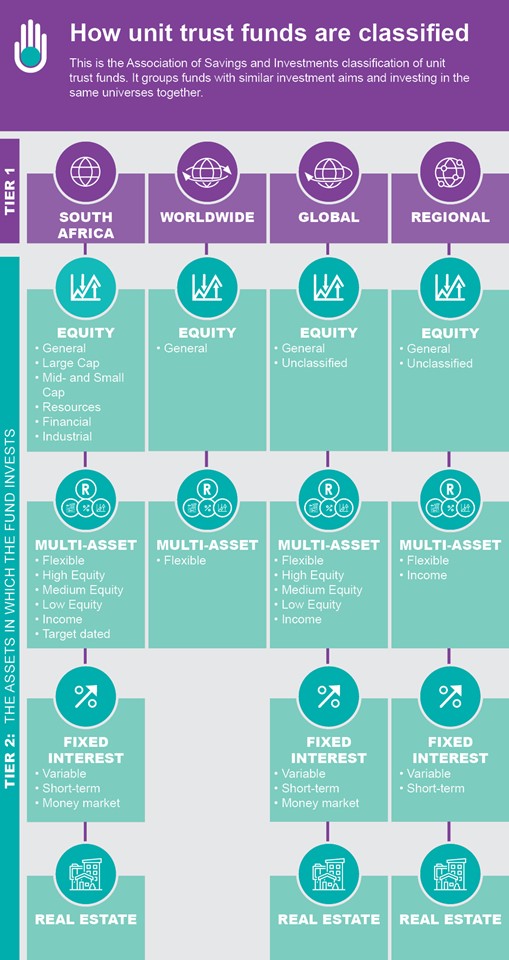

When it comes to what funds to invest in, funds are classified as one of four different types:

Funds are classified first by where they invest and then by what they invest in. When it comes to what funds they invest in, there are four different types:

1. Equity funds

![]() Equity funds invest mostly in shares listed on the stock market – at least 80% of the fund must be in shares at all times.

Equity funds invest mostly in shares listed on the stock market – at least 80% of the fund must be in shares at all times.

A South African equity fund will invest in shares on the JSE, but a foreign equity fund that invests across international markets could include shares from the US, European and Asian stock markets.

Equity funds can focus on certain sectors of the market – for example, financial funds invest in the shares of banks and insurance companies listed in the financials sector of the JSE, while resources funds invest in mining companies listed in the basic materials and oil and gas sectors of the JSE.

Read more: What does it mean if your equity fund specialises or invests broadly?

2. Interest-bearing funds

![]() Interest-bearing funds invest primarily in bonds and other debt instruments issued by governments, companies or banks. These instruments offer a fixed income on the investment.

Interest-bearing funds invest primarily in bonds and other debt instruments issued by governments, companies or banks. These instruments offer a fixed income on the investment.

Some, like bonds, that are issued for longer terms, are not just held for the full period (until maturity), but are traded between investors offering the potential for investors to make capital gains.

Read more: Why interest-bearing investments should be part of your portfolio?

3. Multi-asset funds

![]() Multi-asset funds invest in more than one asset class so you can get exposure to, for example, – shares, bonds, cash and listed property, in a single fund. This offers you another level of diversification and should make your returns less volatile (up and down) than if you invest in a single asset class like equities.

Multi-asset funds invest in more than one asset class so you can get exposure to, for example, – shares, bonds, cash and listed property, in a single fund. This offers you another level of diversification and should make your returns less volatile (up and down) than if you invest in a single asset class like equities.

Read more: Why are there different kinds of multi-asset funds?

4. Real estate funds

![]() These funds invest in listed property shares in the JSE Real Estate sector or similar sectors on international stock exchanges (up to 45% of the fund can be in international markets).

These funds invest in listed property shares in the JSE Real Estate sector or similar sectors on international stock exchanges (up to 45% of the fund can be in international markets).

Their investments include real estate investment trusts (Reits) listed on the JSE and other collective investment schemes in property (previously known as property unit trusts).

Reits are companies that own properties and comply with certain requirements in order to enjoy a favourable tax status.

The key requirements are:

This makes real estate funds ones that can give you a high level of income, but remember the income is taxable when the fund distributes it to you. In addition to income, you can make a capital gain if the price of the Reits and other investments increases.

Reits have either a corporate structure or a trust structure. Those with a trust structure are registered as collective investment schemes in property and were formerly known as property unit trusts.

Property loan stock companies have largely converted to Reits but with a company structure and they are not collective investment schemes.

Real estate unit trust funds must invest at least 80% of the fund’s value in listed property shares locally and internationally in the real estate or equivalent sector and may include other securities with high yields.

Up to 10% of the fund may be invested in shares in other sectors but which are involved in property or property-related activities.