Provisional tax is paid by those who earn income from sources other than a South African registered employer.

It isn’t a separate or additional tax, but simply a way of paying income tax on the income you earn. Provisional tax is a system that ensures you declare and pay income tax during a tax year and not only when your income tax return is assessed at the end of the tax year.

As an employee earning salary or wages, you pay tax to the South African Revenue Service (SARS) on the money you earn throughout the tax year. Your employer deducts tax as Pay As You Earn (PAYE) from each payment it makes to you and pays it over to SARS on your behalf.

However, if you earn income from a business in your own name (not as a company), earn rental or investment income or you are paid as a freelancer or consultant, you will often receive the full amount without any tax being deducted.

Alternatively, you may be paying PAYE as an employee, but you also, for example, earn rental income that could make you a provisional taxpayer.

In terms of the provisional tax system, a certain level of income is set as the threshold for provisional tax. If you earn more than this threshold amount, with just a few exceptions, you must register for provisional tax.

A system to pay

|

PROVISIONAL TAX TIP If you are a provisional taxpayer, it is a good idea to estimate the maximum amount of tax you may pay on your monthly income. Open a separate savings or money market account and transfer the estimated tax payable into that account each month. This way you don’t spend your “tax money” and avoid a cashflow problem when your provisional tax has to be paid. If you err on the side of overestimating what you might pay, it will be a relief to find a lump sum left over once you have made your final payment. You can then use the money to repay debt or to top up your retirement annuity fund as |

The provisional tax system ensures people who earn money from which tax is not deducted upfront, declare and pay tax at least twice during the tax year.

If there was no provisional tax system, SARS would have to wait long after the tax year ends until the end of the tax return filing season for these taxpayers to declare their income, and then only to pay over the tax owed. For some taxpayers it could be a large amount for which they have not provided.

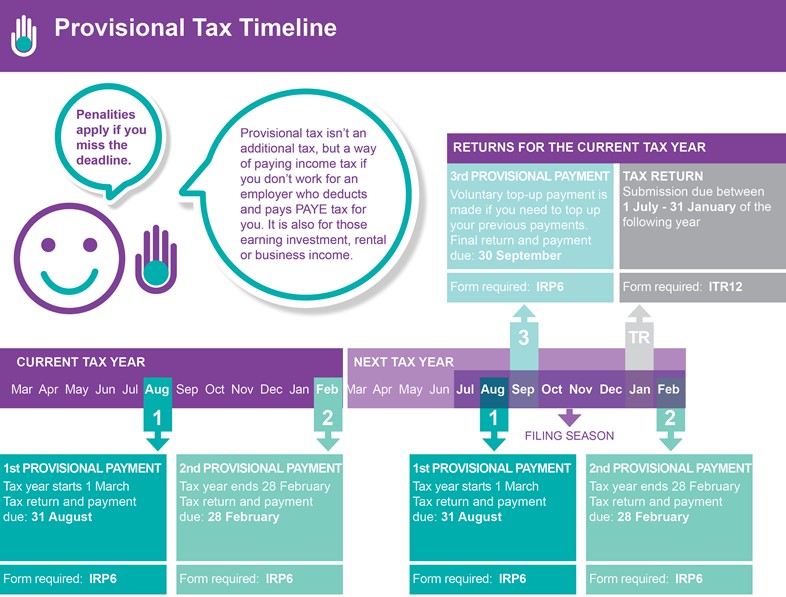

The tax year runs from March 1 each year to February 28 the next year. In terms of the provisional tax system, six months after the tax year starts – at the end of August – you must estimate what you will earn for the year based on what you have earned for the year so far.

SARS then calculates what you will pay in tax for the half year and you are then expected to pay half of that tax by the end of August.

When the tax year ends in February the following year, you must again declare to SARS what you have earned for the year or estimate what you will earn - and pay over the remaining tax due for the second half of the year.

If at the end of February you are still unsure about the amount of income you will earn for the year – perhaps your business income isn’t finalised - you have another chance at the end of September to file a more accurate return, and top up the tax you have paid for the year that ended in February.

The returns

If you are a provisional taxpayer, you have to estimate your taxable income at least twice a year during the tax year on a return known as an IRP6.

You are also, however, expected to file an income tax return – an ITR12 – once the tax year has ended.

Taxpayers, who are not provisional taxpayers, have until the end of the tax filing season – usually around November each year, to file their income tax returns for the year that ends in February. Provisional taxpayers, however, get more time to file theirs – until the end of January the following year.

Overlapping tax years

This can be confusing because provisional taxpayers must file three – or possibly four - times a year as follows:

August: you must file your first provisional tax return for the current tax year;

February: you must file your second provisional tax return for the current tax year that is ending;

September: you can file a third provisional tax return and top up tax paid for the tax year that ended in February (six months earlier).

July to January: you must file an income tax return for the previous tax year (that ended in February – if you wait until the end of January to file, you are filing for the year that ended 11 months earlier).

Beware of penalties

There are no penalties for not submitting a provisional tax return, but if you do not register for provisional tax and pay it on time, SARS will penalise you depending on how much you owe and for how long.

There are also rules about how accurate your estimate of your income should be – if you are way out you may also pay a penalty.