The amount of income tax you will pay on your earnings depends on the income tax brackets that apply to your level of income.

![]() Every year when the Finance Minister presents the budget in February, the level of taxable income to which different tax rates apply – known as the income tax brackets - are announced. The new brackets and rates are applied from March 1 when the new tax year begins. See the latest tax brackets here.

Every year when the Finance Minister presents the budget in February, the level of taxable income to which different tax rates apply – known as the income tax brackets - are announced. The new brackets and rates are applied from March 1 when the new tax year begins. See the latest tax brackets here.

The income tax brackets apply to your annual taxable income. This is your salary plus any additional income such as a bonus, less any tax exemptions and tax deductions you are allowed.

If you are not employed, but are earning business income or consulting or professional fees, your earnings for the year less exemptions and deductions will make up your taxable income.

If you are a salary earner, any contributions to your retirement fund are likely to be your biggest tax deduction, while independent contractors have more scope to deduct expenses incurred earning an income, and can also deduct contributions to a retirement annuity up to the annual limits. Read more: What are the tax advantages of contributing to a retirement fund?

Marginal tax rates

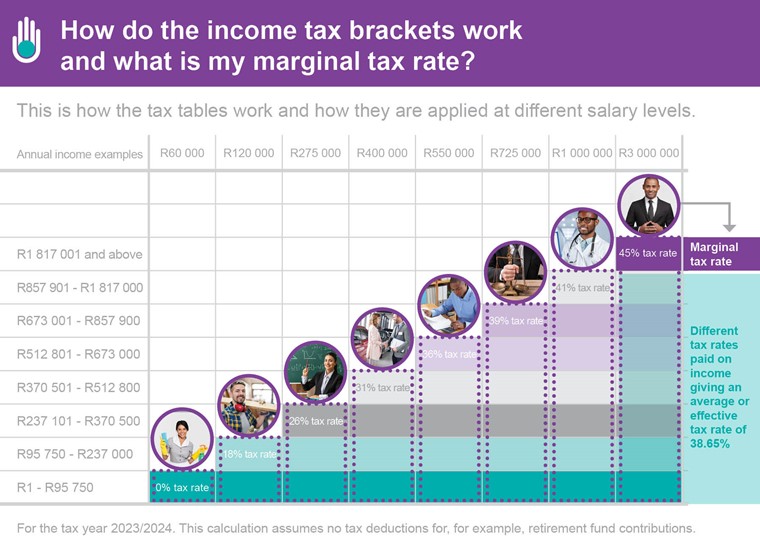

The tax rates that apply to different bands of taxable income in the income tax brackets, are known as marginal tax rates.

Your marginal tax rate is the highest tax rate that applies to a portion – but not all – of your income.

![]() If your annual taxable earnings take you into one of the higher income tax brackets, it is easy to mistakenly think that your marginal tax rate is the rate of tax you pay on all your income. This is not the case.

If your annual taxable earnings take you into one of the higher income tax brackets, it is easy to mistakenly think that your marginal tax rate is the rate of tax you pay on all your income. This is not the case.

The income tax system is what is known as a progressive one, which means you and anyone else who earns income in any band pay the same rate of tax on that portion of your income.

For example, on taxable income earned up to the maximum for the first income bracket, the tax rate for anyone, regardless of how much more than this level they earn, is 18%.

If your income exceeds the maximum for the first tax bracket, but not the maximum in the second bracket, the portion that is above the first tax bracket will be taxed at a rate of 26%.

This means if you are under the age of 65 and your annual income falls in the middle of the second bracket, for example, you are paying 26% tax on only about a fifth of your income.

Close to half of your income will be taxed at 18% and the remainder will not attract tax as it is below the tax threshold (see below)

Your marginal tax rate is 26% because that is the highest rate applied to a portion of your income, but when the total tax you will pay is determined, averaged across your income, your average or effective tax rate will be much lower than 26% - closer to 20%.

The tax threshold and rebate

Under the current tax system, everyone is entitled to earn some income on which they pay no tax.

The amount you can earn without paying income tax is any amount up to what is known as the tax threshold. The tax threshold is adjusted each year for inflation.

In addition, there is a higher threshold for those over the age of 65 but not yet 75 years old, and an even higher threshold for those over the age of 75. See the latest thresholds here.

How the tax threshold applies is not immediately obvious in the tax tables that are published with the Budget each year and put out by the South African Revenue Services (SARS).

This is because SARS uses a tax refund or tax rebate to apply the threshold. The rebate you are entitled to works out to the amount by which your tax should be reduced if you do not apply the lowest income tax rate (18%) to the income you earn below the threshold. See the latest rebates here

Higher incomes, higher taxes

The more income you earn, the higher the rate that is applied to some of your income. Therefore, the more you earn, the more tax you pay. If, however, you receive an increase and move into a higher income tax bracket, your take home pay should still increase.

![]() The only time this does not work is when the tax brackets are not adjusted, or adjusted adequately, to compensate for salary inflation. When this happens a phenomenon known as bracket creep occurs and you can find your inflation-related salary increase putting you in a higher tax bracket and causing you to pay a higher percentage of your income as tax.

The only time this does not work is when the tax brackets are not adjusted, or adjusted adequately, to compensate for salary inflation. When this happens a phenomenon known as bracket creep occurs and you can find your inflation-related salary increase putting you in a higher tax bracket and causing you to pay a higher percentage of your income as tax.

Failure to adjust the tax tables, rebates and exempt amounts for inflation is referred to as income tax by stealth.

If your average tax rate or effective tax rate increases when you have only received an inflation-related increase, bracket creep has occurred.

If you receive an above-inflation salary increase or increase in your earnings, your average or effective tax rate may well increase.