Laura du Preez | 08 June 2023

Laura du Preez has been writing about personal finance topics for more than 20 years, including eight years as personal finance editor for two leading media houses.

More than 70% of consumers surveyed for this year’s Sanlam’s Benchmark Retirement Survey are concerned about not having enough money for retirement.

![]() It is never too late to do something about shortfalls in your retirement savings, but you need to be engaged and appreciate the implications of your choices if you want to improve your future income.

It is never too late to do something about shortfalls in your retirement savings, but you need to be engaged and appreciate the implications of your choices if you want to improve your future income.

Releasing this year’s survey, Sanlam’s retirement industry professionals highlighted that one of the biggest choices you need to make is to preserve your savings – ideally all of it – even after the two-pot system comes into place and allows you to withdraw some of your savings.

South Africans withdraw their retirement savings – often all of it - too often when they change jobs, resulting in less than 10% of members being able to maintain their standard of living when they retire, Lorraine Mekwa, the managing director of client experience at Sanlam Corporate, said at the release of the survey this week.

Two-pot will be significant

This will no longer be possible after the two-pot system is introduced, which will have a significant effect on savings - mostly for younger members, Marian Gordon, the principal investment consultant at Simeka Consultants & Actuaries, said.

![]() Under the two-pot system, one-third of what you contribute to your retirement fund will be held in a savings pot from which you can withdraw once a year.

Under the two-pot system, one-third of what you contribute to your retirement fund will be held in a savings pot from which you can withdraw once a year.

Despite the withdrawals being allowed, the remaining two-thirds of what you save in your retirement pot will have to be preserved until retirement and you will not be able to access this money when you change jobs. Read more: What is the two-pot retirement savings system?

The forced preservation of the retirement pot will have a significant effect on members’ retirement savings, Gordon said.

The numbers prove it

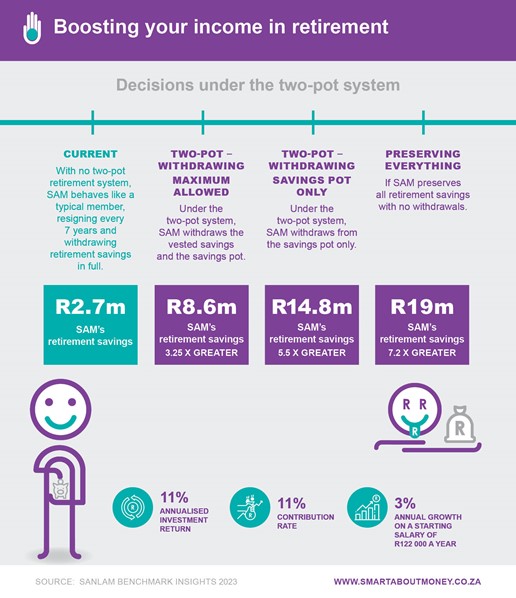

She illustrated this with the example of a member who starts saving at 20 and by age 24 is earning R122 000 a year and has saved R85 000 by contributing 11% of her salary to her fund.

Let's call the member Sam. Gordon said if Sam, like most current retirement fund members, changes jobs every seven years until age 50, and each time she withdraws all her savings, when she retires at age 65, she will only have R2.7 million saved.

Let's assume the two-pot system is implemented when Sam is 24 years old, she won’t be able to withdraw all her savings - she will only be allowed to withdraw the one-third she saves in future. She will also be able to withdraw the R85 000 she had already saved when the system was introduced, known as her vested savings. Despite making these withdrawals, she will still retire significantly better-off with R8.6 million – in excess of three times more.

Let's assume the two-pot system is implemented when Sam is 24 years old, she won’t be able to withdraw all her savings - she will only be allowed to withdraw the one-third she saves in future. She will also be able to withdraw the R85 000 she had already saved when the system was introduced, known as her vested savings. Despite making these withdrawals, she will still retire significantly better-off with R8.6 million – in excess of three times more.

If Sam, does not withdraw the R85 000 she has saved so far, and in future only withdraws the one-third she saves into the savings pot, she will retire with a sum of R14.8 million.

If, however, she chooses not to access either her vested savings or the savings pot, and preserves all her savings until retirement, she could retire with R19 million – more than seven times what she will have if she keeps withdrawing every seven years, Gordon says. Read more: How much do I need to save for retirement?

Withdrawals will hurt you

The example shows how important it is to consider the impact of any withdrawals you make from your retirement savings.

![]() The two-pot system has the potential to deliver on its two objectives of providing access to savings in emergencies and funding an income in retirement, Mekwa says.

The two-pot system has the potential to deliver on its two objectives of providing access to savings in emergencies and funding an income in retirement, Mekwa says.

But there are more pitfalls for members. The danger is that members will treat the savings pot of the two-pot system as a bank account that can be used for frivolous things, and that will be detrimental to their future, she says.

The Benchmark Survey research shows that 38% of members withdraw their retirement savings to fund lifestyle costs. Read more: Why is withdrawing from my retirement fund a bad idea?

Members need to be empowered to explore their choices without hampering their future long-term retirement outcomes. Making use of counselling and financial advice will be key, Mekwa says.

Preserving needs to start early

Mekwa says while the two-pot system will help younger members, it can’t save older members who have not preserved. She said that in contrast to Sam’s case, a member with the same earnings and savings rate as Sam, but who is 51 when the two-pot system is introduced, will experience a much smaller benefit from being forced to save what is in the retirement pot.

![]() The member who has been cashing out every seven years, and continues to withdraw what he contributes to the savings pot, will reach retirement with only R1.4 million saved.

The member who has been cashing out every seven years, and continues to withdraw what he contributes to the savings pot, will reach retirement with only R1.4 million saved.

Older members can, however, improve their retirement savings by not accessing the money in the savings pot when the new system gives you the option to do so, Mekwa says.

Saving more for growth

Older members should also consider making additional voluntary contributions to boost their retirement income and should ensure that their savings are invested optimally.

![]() Anna Siwiak, head of product solutions for Sanlam Umbrella Solutions, says the Benchmark Consumer Survey of 600 retirement fund members shows that many (44%) do not engage with how their savings are invested after joining a fund.

Anna Siwiak, head of product solutions for Sanlam Umbrella Solutions, says the Benchmark Consumer Survey of 600 retirement fund members shows that many (44%) do not engage with how their savings are invested after joining a fund.

A good financial adviser will help you to plan your retirement. Read more: What should I think about when planning my retirement savings?

If you are not on track to get the income you need in retirement, consider saving more. Member data from the Sanlam Umbrella Fund shows that more than 30 000 members out of more than 300 000 are making voluntary additional contributions to their funds. Many (57%) are over the age of 50.

They typically contribute 5% of their salaries in additional contributions, but some contribute as much as 28%, often as a lump sum from, for example, a bonus. Find out how much more you can contribute and enjoy a tax deduction: Tax deductible retirement fund contributions

Stressing or saving

Koketsho Mahlalela, head of member-led outcomes at Sanlam Corporate, says the consumer survey showed more than 50% of consumers would contribute more to their retirement funds if they could.

![]() But almost two in three are stressing about their financial situation and only 20 percent of respondents believe they are getting advice early enough in their lives to improve their finances. Read more: How can I find a good financial adviser?

But almost two in three are stressing about their financial situation and only 20 percent of respondents believe they are getting advice early enough in their lives to improve their finances. Read more: How can I find a good financial adviser?

This could mean that people are living with an extended period of anxiety, not knowing how or what to even think regarding their financial futures, Mahlalela said.

How much do I need to save for retirement?

Why is withdrawing from my retirement fund a bad idea?

What should I think about when planning my retirement savings?

How can I find a good financial adviser?

New proposals could give dismal pension numbers a big boost

Planning for retirement and a good chance you will live to 100

Tax deductible retirement fund contributions