Laura du Preez | 30 August 2021

Laura du Preez has been writing about personal finance topics for more than 20 years, including eight years as personal finance editor for two leading media houses.

Many unit trust investors are shying away from exposure to funds that have the potential to deliver good growth and have lost out on a strong recovery in the local share market after its fall in March last year.

Unit trust statistics released by the Association of Savings and Investment South Africa (ASISA) show that over the past five years there has been a big move out of funds with exposure to equities and into the asset classes that investors perceive as safer – income funds (interest-bearing short-term funds), multi-asset income funds and money market funds.

| South African Funds | Amount investors have invested | |

| June 30 2016 | June 30 2021 | |

|---|---|---|

| Interest-bearing | 24% | 32% |

| Equity | 21% | 18% |

| Real estate | 4% | 2% |

| Multi-asset total | 51% | 48% |

As a percentage of all the money invested in South African funds, the portion allocated to equity and multi-asset funds exposed to equities declined, while there was an increase in fixed income assets from 24% to 32% over the period.

Interest-bearing income funds and multi asset income funds were earning good returns relative to funds with exposure to equities before the market crash at the onset of the pandemic in March last year. Following this, interest rate were cut and the local equity market recovered.

Investors who moved out of equities, however, have been slow to return and those who have returned, have preferred global markets.

The ASISA statistics show that over the past year, income and bond funds have taken the lion’s share of new investments.

Global funds attracted the third highest flows for the year – some R36.9 billion versus the R49 million for local equity funds.

While diversification into offshore markets is good for local investors, returns consistently prove the need for diversification across all asset classes and show the negative effects that ill-timed knee-jerk decisions have on asset classes.

Lost recovery

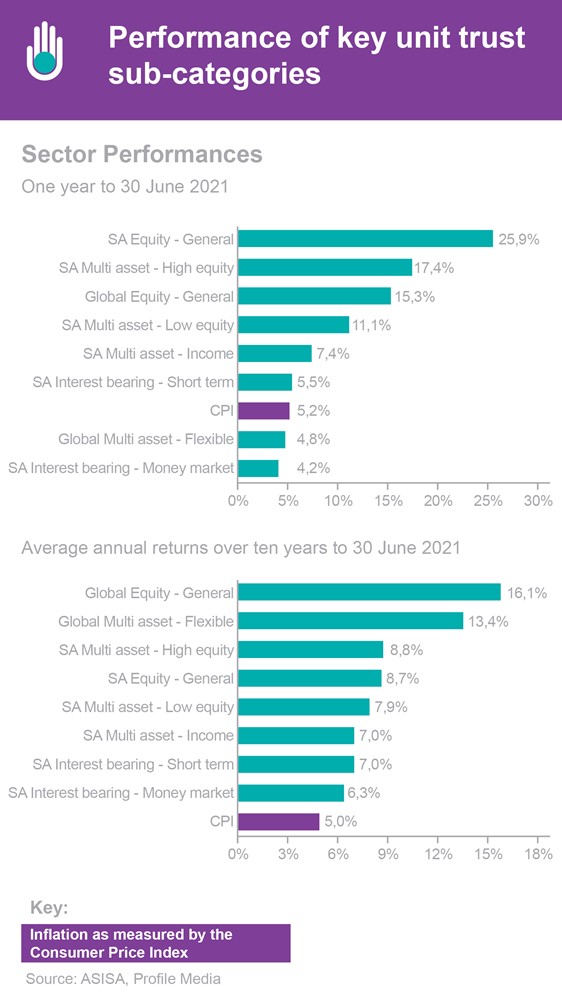

Investors who moved out of equities after the market crash last year, lost out on the recovery in the local share market. South African equity funds returned on average 25.9% for the year to the end of June.

Investors who moved out of equities after the market crash last year, lost out on the recovery in the local share market. South African equity funds returned on average 25.9% for the year to the end of June.

Multi-asset funds with a high exposure to equities were the second-best performer over the year, with an average return that also beat global equity funds - 17.4%. Multi-asset funds invest across the asset classes, giving you greater diversification and returns that are more stable (with less volatility) than equities.

Income funds, however, returned on average 5.5% - barely above the inflation rate of 5.2% - for the year to June, and multi-asset income funds did only a little better at an average of 7.4%.

Investment flows back into funds with exposure to the local share market started belatedly only in the second quarter of this year, after investors noticed the strong returns on the JSE, says Sunette Mulder, senior policy adviser at ASISA.

According to Mulder, a successful investment strategy requires a long-term commitment to a well-diversified portfolio, which includes exposure to equity, together with an understanding that it is time in the market, as opposed to timing the market, that makes all the difference.

Rand disappoints for investors who went global

Investors who went offshore last year after the pandemic arrived on our shores are also likely to be disappointed, says Pieter Hugo, chief client and distribution officer at Prudential Investment Managers.

Hugo says global markets showed an impressive recovery from the global market falls, with the leading index for global markets, the MSCI All Country World Index, returning 42% in dollars over the year to June. Investors in this index would, however, have received only a 10.2% return in rands.

This was as a result of the rand rebounding strongly from its historic lows against major global currencies. The rand was up 17.7% against the dollar, 8.2% against the pound and 13.2% against the euro over the year to the end of June.

Over the year to June 30, rand-denominated global funds returned on average 15.3% for local investors - well below the 25.9% average that local equity funds delivered.

Hugo says investors who went offshore a year to 15 months ago should have thought about the relative valuations – or share price relative to expected earnings of the shares they were switching between.

Fifteen months ago the local share market was cheap and offshore markets were overvalued.

Instead of selling South African assets at lows during the crisis, it would have been much more lucrative to have sold expensive developed market equities and used the proceeds to add South African equity and bond exposure.

Pessimism keeps local shares down

Hugo says investor sentiment towards South Africa continues to be extremely pessimistic. Some of this pessimism is merited given the likely under-reporting of Covid-related deaths, lack of trust in a variety of institutions, the recent social unrest, weakening economic growth and rising government debt.

This pessimism has kept share valuations low - the prices of local shares are low relative to companies’ improved earnings. Growth in company earnings has been surprisingly robust, and the damage caused by the July unrest has not impacted meaningfully on the ability of listed companies to earn profits in the future, Hugo says.

The measures that asset managers use to determine how expensive or cheap shares are, such as price to earnings and price to book – are low relative to their historic averages and low relative to global averages, Hugo says. The differences have not been as wide since the global dot-com bubble in the early 2000s, he adds.

This improves the odds of South African shares outperforming global equities in the future, he says.

|

STAYING THE COURSE IN A DIVERSIFIED FUND Recently the JSE and FTSE Russell launched a new set of indices that show the returns you would have earned from a defined mix of asset classes each represented by their own indices. 10.28% a year: This is the average annual return over the past ten years to July 31, 2021 from one of these indices. Investing in a multi asset fund holding 55% in the JSE via the All Share index, 15% in the local bond market via the All Bond index, 20% in global markets via the FTSE Global all Cap index (excluding South African shares) and 5% in global bond markets through the FTSE World Government Bond Index, would have earned you this return. |

Rebound not over

Anet Ahern, CEO of PSG Asset Management, is also of the view that the local share market’s rebound is not over despite the July unrest.

The bad news and noise will not stop more growth, as South African stocks have only moved from being extremely cheap to cheap, she says.

Ahern says it is good to have offshore exposure and you can build a good offshore portfolio now if you are prepared to invest in global shares that are not in leading indices like the S&P500 or MSCI World.

The indices are very skewed towards expensive stocks such as Apple, now worth more than all the shares in the energy, utilities and basic materials sectors of these indices.

It is easiest to build a portfolio that differs from the index using an actively managed unit trust fund, Ahern says.

She says global flexible multi-asset funds that can allocate between shares and cash depending on the outlook for the market, are a good choice for now.

Understand what you hold

Investors who moved out of multi-asset funds, however, should think about what is in these funds, she says.

Most multi-asset funds have close to the maximum of 30% in overseas markets and around 50% of their exposure to the local market is to shares that have strong earnings from foreign markets or from exports (rand hedge shares), Ahern says.

Ahern says if you need to increase your offshore exposure do so by phasing in small amounts each month to avoid bad timing.

If you had a good balance of asset classes in your investments, the best thing you could have done last year was nothing, she says. This would have been apparent if you understood what you have in your portfolio, she says.

It is wrong to think of South African funds as investing only in South Africa, she says. There are not many truly local companies on the JSE and the recovery in global economy will influence the recovery of many local shares.

What kinds of unit trusts are there?

Why are there different kinds of multi-asset funds?

Fund classification tool