Laura du Preez | 07 April 2022

Laura du Preez has been writing about personal finance topics for more than 20 years, including eight years as personal finance editor for two leading media houses.

The recent increase in the maximum amount retirement fund investors can invest offshore – from 30% to 45% – raises the question: should you take more offshore and if so, how much?

Three asset managers who have been researching and back-testing the optimal levels have shared their views. This kind of research informs managers’ long-term target allocations to offshore markets, but they also have views on shorter-term opportunities that may lead them to increase or decrease these optimal levels.

Many are seeing more opportunities in the local equity and bond market and fewer opportunities in global equity markets where many shares are trading at expensive levels. Read more: The investment grass isn’t always greener on the other side.

John Anderson, executive for Investments, Products & Enablement at Alexander Forbes, says the optimal offshore allocation for your retirement investments depends on your investment goals and the return you are targeting relative to inflation. Read more: What are the key things I need to know before I start investing?

The main goal for most people saving for retirement is to provide for an income or pension in rands in their retirement.

Alexander Forbes’ research shows the “sweet spot” for offshore allocation for you, if this is your goal, is between 25 and 27.5% of the portfolio, Anderson says.

Remember that many companies listed on the JSE earn a large proportion of their earnings from foreign sources and are impacted more by factors outside of South Africa and the rand, rather than by the local economy. You should take this into account when you make decisions on allocations, Anderson says.

If you have significant wealth, your goals may be different and higher allocations may be appropriate, he says.

Saving for retirement

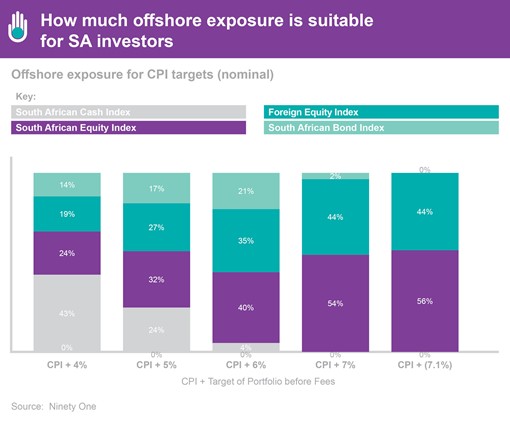

Ninety One’s research shows the optimal offshore exposure for retirement savers invested for the long term, and targeting returns of six or seven percent above inflation, is between 35% and 44%, Jaco van Tonder, the manager’s adviser services director, told members of the Financial Planning Institute at a recent online event.

Ninety One’s research shows the optimal offshore exposure for retirement savers invested for the long term, and targeting returns of six or seven percent above inflation, is between 35% and 44%, Jaco van Tonder, the manager’s adviser services director, told members of the Financial Planning Institute at a recent online event.

Ninety One tested the optimal allocation by applying market returns from the past 120 years to a lump sum invested in a retirement fund for 30 to 40 years and targeting returns above inflation over 10 to 15 years.

The manager looked not only for the best returns but for those without too much volatility, Van Tonder said.

| The optimal foreign equity exposure for investments targeting different returns above inflation (CPI) as calculated by Ninety One. |

The optimal levels are within the new 45% offshore limit for retirement funds, he says.

Greater flexibility

Anderson says while an offshore allocation of no more than 27.5% is the optimal long-term target for most retirement savers, managers may allocate up to 10% more or less than this amount depending on short-term variations in the market and their outlook for returns from the different asset classes.

This is now possible with the increased flexibility in the limits. However, it is very important to ensure that the managers you choose have the skill and experience to add value via asset allocation, he says.

At the moment, many managers are seeing value in South African equities and bonds and hence the general allocation to offshore is below 30%, he adds. Read more:

Exposure in living annuities

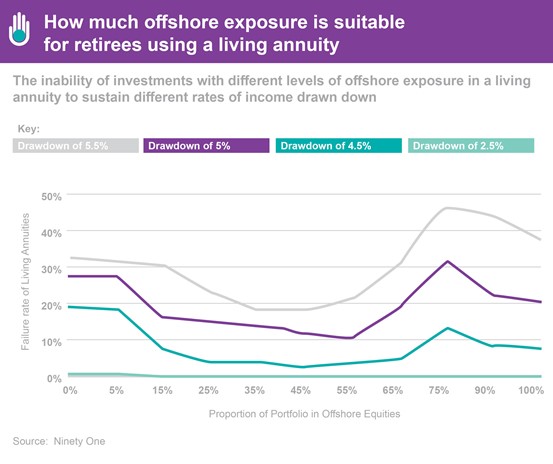

Ninety One also considered what the appropriate level of offshore exposure is for retirees drawing a pension income from an investment-linked living annuity.

There are no offshore limits on living annuities and so Ninety One tested offshore allocations ranging from 0% to 100% of the investments and how this impacted the ability of the investments to sustain different levels of income drawn from the annuity.

Ninety One tested the different income levels using returns from the past 120 years and considered how often the investments failed to sustain the required level of income for a 30-year retirement.

In deciding the optimal offshore exposure, it looked for levels where the investment’s rate of failure to sustain the required income was 10% or less.

Van Tonder says if you are drawing a low amount from your living annuity – the lowest amount allowed is 2.5% of the capital amount a year - it makes no difference whether you invest 0% or 100% offshore.

amount allowed is 2.5% of the capital amount a year - it makes no difference whether you invest 0% or 100% offshore.

However, if you are drawing 4.5% or more, your living annuity is more likely to fail to sustain this income level when your offshore exposure is below 15%.

The research indicates that an offshore exposure of between 35% to 45% is about the right level for pension withdrawals of between 4.5% and 5.5% of the capital, Van Tonder says.

It also shows that you can have too much offshore exposure in a living annuity, he says.

When the offshore exposure increases beyond around 55% of your investments, the rate at which the annuity fails to sustain an income of 4.5% to 5.5% of the capital increases, Van Tonder says.

Anderson says an allocation of more than 45% to offshore investments adds significantly to the volatility. Retirees drawing an income from a living annuity need to be particularly careful about how much they draw when their investments take a downturn as this can affect the ability of the annuity to sustain the income you need in future. Read more about sequence risk in this article: What are the risks when drawing retirement income from investments?

Cautious investors should have less offshore

Urvesh Desai, portfolio manager Old Mutual Investment Group, told a recent conference for retirement fund trustees and principal officers hosted by their representative body, Batseta, that the volatility of the rand means conservative investors who are concerned about losing money and have lower exposure to equities, should have a much lower exposure to foreign markets than 45% - or even 30% of their investments.

Desai says Old Mutual’s research found the optimal level of offshore exposure for the high equity balanced fund – one for investors who can stay invested for longer periods and weather the volatility - is 35% - 25% in global equities and the remainder in global bonds and listed property.

Old Mutual’s asset managers adjust this allocation, depending on the valuations in the respective markets or the economic environment or investment themes that are playing out, he says. Read more: The investment grass isn’t always greener on the other side.

The rand is the diversifier

Desai says ideally you should diversify into asset classes and regions that are not well correlated, so the different parts of your investment deliver better or poorer returns at different times and overall your returns are smoother. Read more: Why should I diversify my investments?

The rolling 10-year returns of global bonds and global equities appears to show that they are largely uncorrelated to the returns of local equities, Desai says.

However, when you ignore the impact of the rand and compare the rolling returns in rands from local equities to that of global equities measured in dollars, the correlation is much higher resulting in less diversification, Desai says.

This shows the currency is a major part of the diversification - the performance of the asset classes changes over time, but it isn’t necessarily true that global markets provide better returns than local markets, Desai says.

When the returns of the two asset classes are measured in a common currency, it highlights how a depreciating rand has often boosted global returns for South African investors.

Beware of volatility

The rand is, however, volatile - the rand to the US dollar exchange rate measured over rolling one-year periods shows the rand frequently adds or subtracts in excess of 20% a year to returns and sometimes as much as 60%, Desai says.

Diversifying into offshore markets with more companies and sectors than South Africa should lower your risk, but offshore returns are also significantly affected by the rand and this volatility is a risk, Desai says.

You need to consider your investment goals and returns in one currency. For many South Africans that is the rand.

The new higher offshore limits may give you greater flexibility to increase your offshore exposure and potentially your returns. As an investor, however, you should think very carefully about your exposure to global markets – taking higher amounts offshore, particularly when the timing is bad, gives you more scope for bad returns as well, Desai says.

What are the key things I need to know before I start investing?

How are my retirement savings invested?

What should I think about when planning my retirement savings?

Which underlying investments are best for a living annuity?

How much should I draw as a pension from a living annuity?

What are the risks when drawing retirement income from investments?

Do unit trusts invest in financial markets outside of South Africa?