Laura du Preez | 05 April 2022

Laura du Preez has been writing about personal finance topics for more than 20 years, including eight years as personal finance editor for two leading media houses.

After a decade of global equity markets delivering better returns for South African investors than local markets and South Africa’s economic growth remaining low, it’s easy to believe that the investment grass is always greener elsewhere.

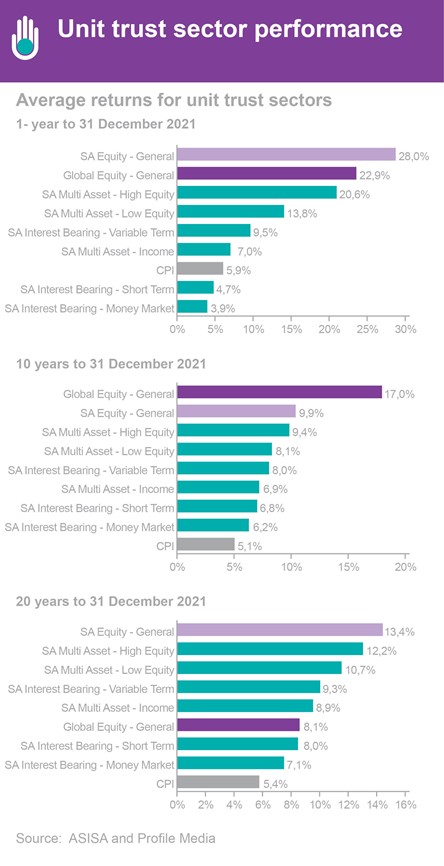

Last year, however, local equity funds returned 28% on average, beating the global equity funds available to South Africans by a wide margin of six percentage points, according to statistics released recently by the Association for Savings and Investment South Africa (ASISA).

Last year, however, local equity funds returned 28% on average, beating the global equity funds available to South Africans by a wide margin of six percentage points, according to statistics released recently by the Association for Savings and Investment South Africa (ASISA).

The JSE’s 29% return as measured by the All Share index, resulted in multi-asset funds also delivering good returns – those with highest exposure to the share market – the high equity multi-asset funds, returned 20.6% for the year to the end of December 2021.

Over the past decade, the average returns from global equity funds available to South Africans was 15.3% a year while local equity funds returned on average only just over half of that – 7.9% a year, ASISA’s stats show.

While a decade is a long time to enjoy much lower returns, a longer-term focus shows why it may be wise to have exposure to both asset classes. Over the 20 years to the end of December last year, local equity funds achieved an average return of 13.4% a year.

Despite strong average returns over the past decade, for the past 20 years global equity funds returned on average 8.1% - almost five percentage points less each year than local equity funds.

Global growth fading

A number of fund managers are currently finding investment opportunities in South Africa, despite growth in the local economy remaining weak.

Mikhail Motala, fund manager at PSG, told the recent virtual Meet the Managers conference that the past decade was one characterised by low interest rates, low inflation and muted economic growth globally.

The share market has during this time latched on to companies that have taken market share, disrupted industries or innovated and hence grown their earnings or profits, he says.

The big technology shares were the hallmark of these growth stocks.

But the current extreme conditions in global markets have given rise to “under-appreciated quality shares going on sale”, Motala says.

Quality shares are shares of companies that are well-managed businesses, have strong balance sheets, strong cashflows, and a competitive edge.

Many of these shares are value shares as their share prices are lower than the value of the business.

Motala says this has created a “generational buying opportunity’’ – an opportunity seen once in a generation in global value shares. The next decade’s winners may be different to those of the past, he says.

Fund managers look locally

These shares are exactly the kind PSG invests in – those of companies with strong management, a competitive edge and a margin of safety in a share price trading below the company’s fair value.

These companies’ shares are improving, but it is only the beginning of the performance cycle, he says.

While PSG is buying global shares, it is also finding significant similar opportunities on the JSE, Motala says.

PSG is often asked why it is confident enough to invest money in South Africa when the headlines are as negative as they are, he says.

“But we are not investing in a unit called South Africa, or in the ANC,” he says.

“We are investing in good quality companies run by competent management teams who make a plan in tough times. And the reason we are getting to buy these cheap is because of the sentiment toward South Africa.”

Motala says one of PSG’s biggest holdings is in Remgro, but it is also excited about mid-cap shares like Hudaco in which a smaller manager like PSG can take a sizeable stake.

Local value is lekker

Iain Power, chief investment officer at Truffle, told the Meet the Managers conference that when you look around the world, value is hard to find.

The shares in the MSCI World Index are trading at almost 20% more than their middle-of-the-range or median returns over the past 10 years, he says.

The S&P500 is expensively priced on peak earnings – reflecting a 27% increase over the median of its 10-year returns, Power says.

Growth shares are trading at 50% more than the median of their 10-year returns.

The shares in the JSE’s All Share index look quite cheap relative to many markets around the world, Power says.

It is also positive that many local companies should benefit from higher inflation globally as investors look for higher yielding shares – those of companies generating spare cash and paying good dividends.

Best bets at home

Andrew Vintcent, director and portfolio manager at ClucasGray, told the Meet the Managers conference that the local exposure in ClucasGray’s South African multi-asset fund was the highest it has ever been in the fund’s seven-year history.

South African equities have been way too inexpensive for far too long. Local equities are the standout opportunity, despite a strong recovery in these shares over the past 18 months, Vintcent said.

Improving company earnings (profits), significant support from low valuations (share prices relative to earnings), and a stabilising rand have all contributed to the recovery of local equities in the ClucasGray Equilibrium Prescient fund against global equity, he says.

As a South African multi-asset fund, the fund was able to take its offshore exposure to 30% until last month when the offshore allowance was increased to 45%.

Vintcent said despite this ClucasGray had recently reduced the global equity weighting in the fund and the fund has never owned less global equity – just 16% compared to 56% in local equity.

Vintcent says there are currently limited opportunities for global assets in most regions to deliver real (after inflation) returns, compared to what investors are being presented with in the local market.

Rising interest rates, elevated energy costs, and a stronger US dollar point to slowing US economic growth, he says.

Relative valuations become important if earnings growth slows, Vintcent says.